Are you planning a trip to Qatar and wondering how to stay safe during your visit? Travel health insurance is now a must for all international visitors entering Qatar. This regulation ensures you are covered for medical emergencies, providing peace of mind while exploring this vibrant country. Let’s dive into everything you need to know about Qatar’s travel health insurance requirements and how to secure your policy effortlessly.

Qatar Travel Health Insurance. [Quick Answer]

- Apply for your Qatar visa via the Metrash app.

- Choose an MOPH-approved insurance provider.

- Pay QR50 for 30 days of coverage.

- Receive policy documents and visa approval.

- Insurance covers medical emergencies, ambulance costs, and COVID-19 care.

Why Is Travel Health Insurance Mandatory in Qatar?

As of February 1, 2023, Qatar has mandated travel health insurance for all international visitors. The goal of this rule is to:

- Provide easy access to medical care in emergencies.

- Control healthcare costs for visitors and the government.

- Enhance Qatar’s reputation as a safe travel destination.

This requirement guarantees that tourists can receive medical attention without worrying about expenses during their stay.

Who Needs Travel Health Insurance in Qatar?

This mandatory insurance applies to most visitors, including:

- Tourists applying for any type of visa, such as family, business, or transit visas.

- Visa-on-arrival tourists extending their stay beyond 30 days.

However, there are a few exceptions:

- Stays shorter than 30 days (though insurance is still highly recommended).

- Australian citizens on short-term visits.

- Gulf Cooperation Council (GCC) nationals visiting Qatar.

Even if exempt, purchasing travel health insurance is a smart choice to avoid unexpected medical expenses.

How to Get Travel Health Insurance for Qatar

Getting travel insurance is simple and can be done in just a few steps:

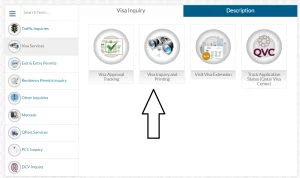

- Apply for a Qatar Visit Visa

Use the Metrash app or an authorized visa application service to begin your visa application. - Choose an Approved Provider

Select a health insurance provider approved by Qatar’s Ministry of Public Health (MOPH). - Purchase Your Insurance Plan

Complete the payment online. The standard cost is QR50 (around $14) for 30 days of coverage. - Receive Your Visa and Policy

Your visa will only be issued once the required insurance is purchased. - Save Your Documents

Keep a copy of your policy to present if needed during your stay.

What Does Qatar Travel Health Insurance Cover?

The basic visitor health insurance plan includes:

- Emergency medical treatment: Coverage up to QR150,000.

- Ambulance transport: Costs up to QR35,000.

- COVID-19 treatment: Coverage up to QR50,000.

- Quarantine expenses: Up to QR300 per day.

- Repatriation costs: Coverage up to QR10,000.

This comprehensive coverage ensures tourists receive necessary medical care during their visit.

Validity of Travel Insurance in Qatar

- The policy becomes valid when you arrive in Qatar.

- Coverage lasts for 30 days. If your visa is extended, you’ll need to purchase a new plan.

- For single-entry visas, insurance ends when you leave the country.

- For multiple-entry visas, insurance remains active until the policy’s expiration date.

Cost of Travel Health Insurance

Qatar has set an affordable standard rate of QR50 (approximately $14) for 30 days of coverage. If you plan to stay longer, you can purchase additional coverage from approved providers.

Assistance for Visitors

If you need help with your Qatar travel health insurance, contact:

- MOPH Helpline (within Qatar): 16000 (Health Insurance extension).

- For international inquiries: +974-4406-9963.

- Email: [email protected].

The Ministry of Public Health provides multilingual support to ensure all visitors can navigate the process smoothly.

Frequently Asked Questions

Q1: Is health insurance mandatory for Qatar visas?

Yes, all visitors must have health insurance to enter Qatar.

Q2: How much does visitor insurance cost?

The minimum cost is QR50 for 30 days of coverage.

Q3: Can I extend my insurance policy?

Yes, you can purchase additional coverage if extending your stay.

Q4: What does the insurance cover?

It includes emergency treatment, ambulance services, COVID-19 care, and more.

Q5: Do GCC nationals need health insurance?

No, GCC citizens are exempt from this requirement.

Q6: How do I buy a policy?

During the visa application process, choose an approved provider and pay online.

Q7: Can I cancel my insurance?

No, Qatar visitor insurance policies cannot be canceled once issued.

Hey there, I’m Hamza Al-Abdullah, the brains and heart behind Qatarvisacheck.qa. Proudly rooted in the bustling city of Doha, Qatar, I’ve made it my mission to untangle the visa web for fellow travelers. My website isn’t just a hub for visa info; it’s a personalized journey through the often confusing world of travel documents.

Hello sir could you please guide me a bit on visa on Arrival process for a friend who wants to visit Qatar for a one week?

Is it important to book a hotel reservation through Discover Qatar or can he stay at a bachelor’s motel??

Please guide me on it. It’ll be a great help.

Thank you.